Invest in Mutual Funds using a Robo Advisor

Is an online platform any different from offline mutual fund advisors?

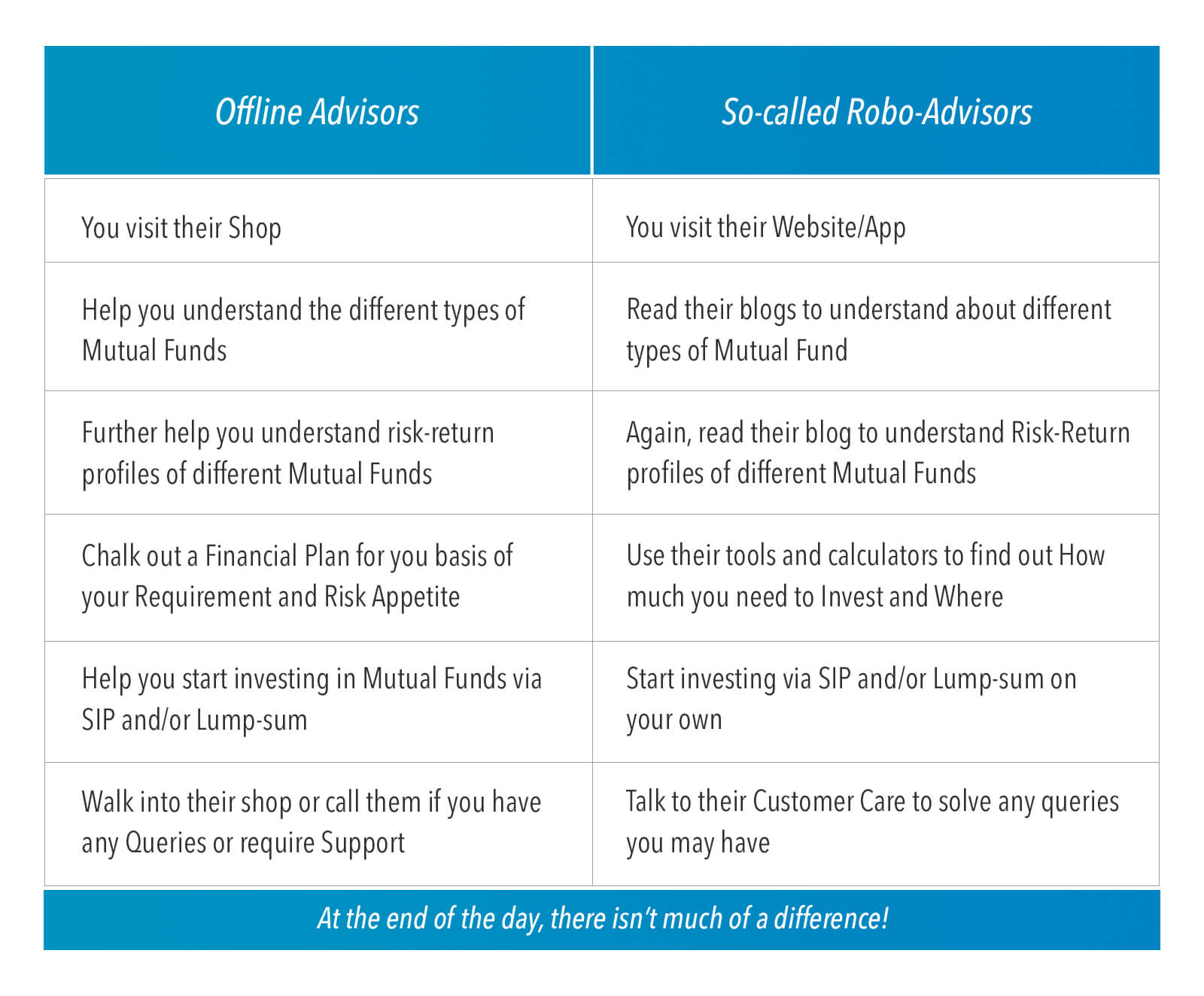

Turns out that they are awfully similar. The only benefit that an online platform offers is convinience of investing.

Online portals who claim to be robo-advisors are simple replacements. The table on the right shows how similar a typical online platform is to a conventional offline advisor.

Online portals who claim to be robo-advisors are simple replacements. The table below shows how similar a typical online platform is to a conventional offline advisor.

Earlier, you had to fill forms to invest in mutual funds. Now, you need to type in the same information to do it. Earlier you had to pay by cheque. Now you can pay through net banking.

Only thing that has improved is convenience.

But is that the only extra thing that a robo advisor should offer? Convenience? Not exactly. A robo advisor should offer much more.

How many of these online portals actually offer you automated rebalancing, portfolio optimization and most importantly, intelligent investment strategies?

A robo advisor is much more than just an online transaction platform

A robo advisor is much more than just an online transaction platform

A true robo advisor should offer you much more than a transaction platform. It should take care of every aspect of investment once you start with them.

A true robo advisor should allow you to invest in mutliple financial goals and build a customized solution for each goal.

Planning and execution of a financial goal should not only be automated but should also be based on a realistic assumptions and assessment. Further, there should be an automatic process for goal review and corrrective actions.

Given a financial goal, a robo advisor should get your asset allocation right. A common way of asset allocation is to give you a list of questions and assess your risk appetite. We at Finpeg think that this is fundamentally wrong.

A correct way to determine asset allocation should be driven by your goals and your investing capacity.

Getting you the right portfolio should be based on comprehensive research to select the best mutual funds. Check out Finpeg's CRAFT Framework, our fund recommendation engine.

What happens when a mutual fund starts under performing? A robo-advisor should have a comprehensive strategy to keep your portfolio optimized - remove the under performers from your portfolio. Plus, this entire optimization should be executed in an automated manner.

You start off with a particular asset allocation of debt and equity based on your goals. Over time, the debt and equity percentage changes completely from the original allocation.

A robo-advisor should have a proper rebalancing strategy in place so that the intended asset allocation is maintained. Plus, it should have the execution infrastructure to execute the rebalancing in an automated manner.

And Finpeg is much more than just a simple robo advisor

And Finpeg is much more than just a simple robo advisor

While a robo advisor is much more than a simple online platform, Finpeg is much more than just a simple robo advisor. Our advisory is not just automated, it is also intelligent.

While a robo advisor may automate every aspect of your investment, does it offer any signficant alpha over your regular SIP or lump sum investments?

It may do automatic rebalancing. But does that yield extra returns or just reduces the risk? Does it help you enter the markets when prices are low and exit when prices are high? Is there any rebalancing logic based on market condition and momentum?

At Finpeg, we offer solutions that genuinely deliver a tangible alpha. Using various inputs like PE ratio, PB ratio, Interest Rates, we have trained our algorithm to decide the most optimal asset allocation at any given point of time. Along with the alpha, our strategies offer phenomenal risk reduction.

Be it a generic NIFTY Index or a portfolio of actively managed funds, our strategies have consitently generated 3% - 5% alpha over regular SIPs or lump sums.

For intelligent SIP solution, check Finpeg AlphaSIP.

For intelligent lump sum solution, check Finpeg Lump Sum Strategy

Algorithms are where the robo ends. Apart from that, everything else is human

When it comes investment algorithms and strategies, we are all robo and machines. But apart from that, everything else is human.

You get a dedicated relationship manager who takes care of your entire investing journey. From getting your KYC done to explaining you the strategies to being there for all your queries all the time. And yes, your relationship manager is indeed human!

Algorithms are where the robo ends. Apart from that, everything else is human

When it comes investment algorithms and strategies, we are all robo and machines. But apart from that, everything else is human.

You get a dedicated relationship manager who takes care of your entire investing journey. From getting your KYC done to explaining you the strategies to being there for all your queries all the time. And yes, your relationship manager is indeed human!