It's time to upgrade your Mutual Fund SIP to AlphaSIP

AlphaSIP is a smarter and a better way to invest in Mutual Funds. A data and algorithm driven approach to Mutual Fund investing.

The smartest way to invest in Mutual Funds

The smartest way to invest in Mutual Funds

Using intelligent asset allocation and portfolio optimization techniques, AlphaSIP offers much better returns than your plain SIP investments.

Using intelligent asset allocation and portfolio optimization techniques, AlphaSIP offers much better returns than your plain SIP investments.

Automatic rule-based rebalancing between debt & equity, driven by intelligent investment algorithms

Dynamic asset allocation for unparalleled mix of return maximisation and downside protection

Lower volatility and drawdowns because of effective and timely rebalancing during market downturns

A scientific and data-driven framework to select the best mutual funds for your portfolio

Power of algorithms, applied to your investments

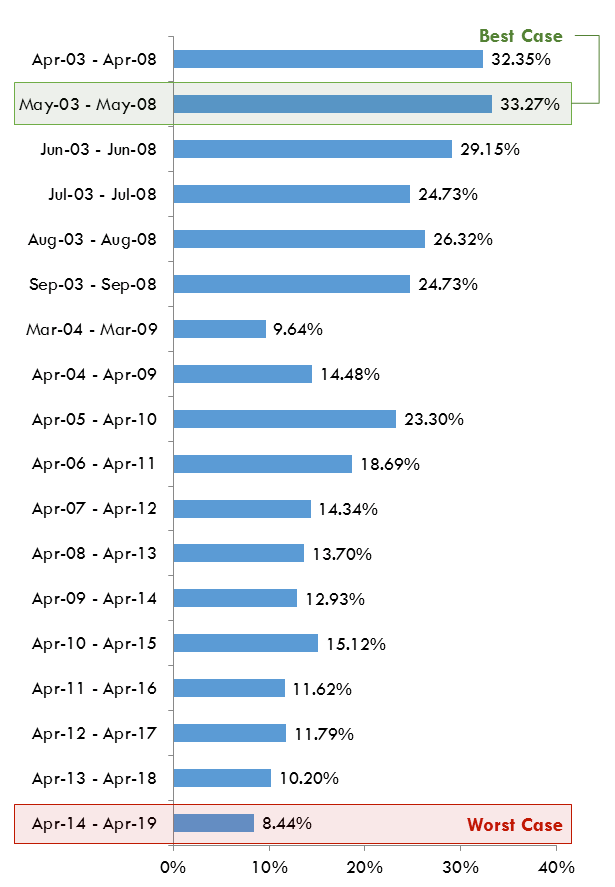

If you were to invest in NIFTY index every month for 5 years, Finpeg's AlphaSIP strategy would have delivered higher returns than a regular SIP a staggering 98% of times (since 2001).

How does it all work?

How does it all work?

Finpeg’s AlphaSIP Strategy is driven by a proprietary multivariate investment algorithm that dynamicaly adjusts asset alocation between equity and debt funds based on changes in the folowing input parameters

Finpeg’s AlphaSIP Strategy is driven by a proprietary multivariate investment algorithm that dynamicaly adjusts asset alocation between equity and debt funds based on changes in the folowing input parameters

Measured in terms of PE ratios of NIFTY50 and S&P500

Trajectory of G-Sec yields and credit spreads

Inflation and GDP trajectory globally

Leading global economic activity indicator like ECRI

Interest rate abd balance sheet stance of US Federal Reserve, ECB and BoJ

Interest rate abd balance sheet stance of US Federal Reserve, ECB and BoJ

Lower volatility, better returns

What if your SIP investments can shoot up during market rallies but be steady like Bank FDs during market downturns? That's the power of Finpeg's intelligent & dynamic asset allocation strategy.

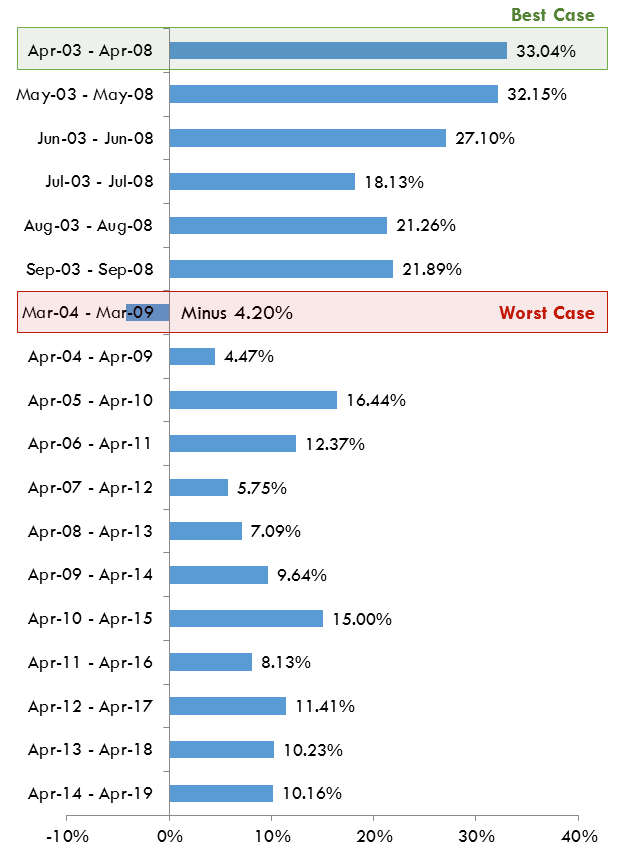

Improving SIP performance using PE ratio, an illustration

Improving SIP performance using PE ratio, an illustration

Here’s an ilustration of how Market Valuation (i.e. PE ratio of NIFTY), an input parameter of Finpeg’s investment algorithm can be leveraged to improve performance of aconventional SIP

Here’s an ilustration of how Market Valuation (i.e. PE ratio of NIFTY), an input parameter of Finpeg’s investment algorithm can be leveraged to improve performance of aconventional SIP

| Average Case | 10.97% |

| Worst Case | -4.20% |

| Best Case | 33.04% |

| Average Case | 15.23% |

| Worst Case | 8.44% |

| Best Case | 33.27% |

Sounds interesting? Request a call back

Don't start investing with Finpeg if you are not convinced. Leave your details and someone from our wealth management team will get in touch to explain AlphaSIP in detail.