Best mutual funds for lump sum investment in 2020.

Here are the best mutual funds for lump sum investment in India in 2020

We list down the best mutual funds in each category.

Here are the best SIP mutual funds to invest in India in 2020

We list down the best mutual funds in each category.

| Scheme type | Scheme name |

|---|---|

| Equity Large Cap | Miare Asset Large Cap Fund |

| Equity Mutli Cap | Axis Multi Cap Fund |

| Equity Mid Cap | Axis Mid Cap Fund |

| Equity Small Cap | HDFC Small Cap Fund |

| Equity Large & Mid Cap | Mirae Emerging Blue chip Fund |

| ELSS | Mirae Asset Tax Saver Fund |

| Scheme name and type |

|---|

| Mirae Asset Large Cap Fund (Equity Large Cap) |

| Axis Multi Cap Fund (Equity Multi Cap) |

| Axis Mid Cap Fund (Equity Mid Cap) |

| HDFC Small Cap Fund (Equity Small Cap) |

| Mirae Emerging Bluechip Fund (Equity Large & Mid Cap) |

| Mirae Asset Tax Saver Fund (ELSS) |

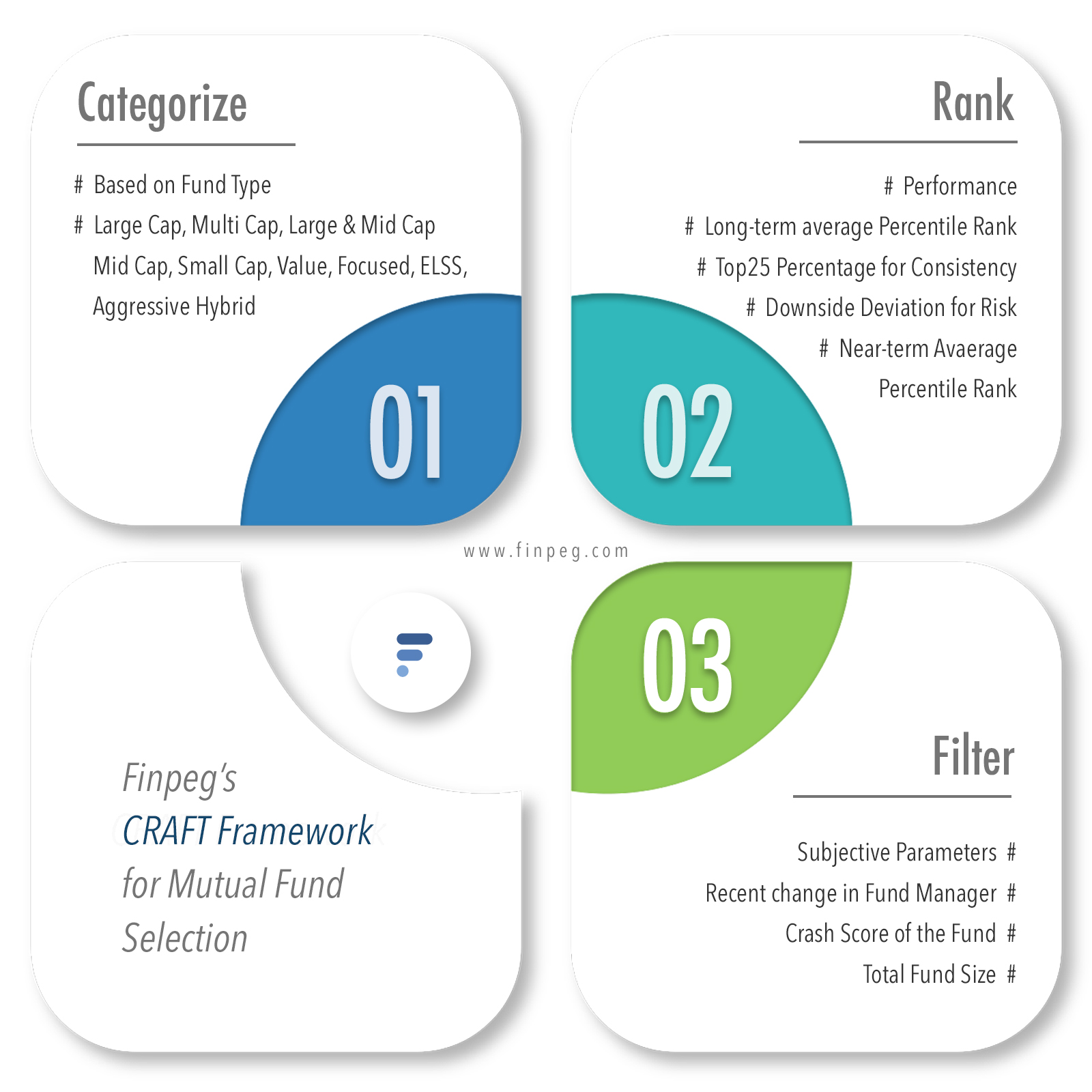

Best Mutual Funds for lump sum investment selected through CRAFT Framework

A comprehensive rank-based framework that uses past 20 years of data to pick out the best mutual funds.

Finpeg's cutting-edge CRAFT Framework to pick the best SIP Mutual Funds

A comprehensive rank-based framework that uses past 20 years of data to pick out the best mutual funds.

Categorize, based on Fund Type

The first step is to categorize the funds into different categories based on their type. For example, large cap is one such category. The main idea here is that you want to compare funds within a category and NOT across categories. Something on the lines of making apple-to-apple comparison.

Rank, based on Fund Performance

Once we have the categories, the next step is to rank the funds within each category. Ranking should be done for funds within a category and NOT across categories. The guiding philosophy that this framework follows can be summed up in a single sentence – “Long-term track record of consistent performance”.

Filter, based on qualitative assessment

And finally, once we have ranked the funds, we should filter funds based on qualitative assessment. Qualitative factors include any recent change in fund manager, total size of the fund and performance of the fund during times of steep market crash. More details on the framework here.

Picking the best Mutual Funds is just a start. You can still go wrong

When you invest a lump sum amount in equity mutual funds, you are taking a big market timing risk.

Picking the best Mutual Funds is just a start. You can still go wrong

When you invest a lump sum amount in equity mutual funds, you are taking a big market timing risk.

As is evident from the chart, timing plays a big role in your long-term returns.

If you invest in the NIFTY Index at a time when NIFTY PE is above 25, your average 5-year returns are 2.8% and in some cases, you would have even lost money.

On the other hand, if you invest in NIFTY index when PE is below 15, your average 5-year returns are are a whopping 27.1%.

Even though we know that timing matters for lump sum investment, timing the markets is not easy.

Even with best Mutual Funds, you can end up with negative returns?

Even with best Mutual Funds, you can end up with negative returns?

Introducing the most intelligent way to do lump sum investment in mutual funds

Using advanced machine learning techniques, Finpeg Lump sum strategy offers a far better alternative to regular lump sums.

Introducing the most intelligent way to do lump sum investment in mutual funds

Using advanced machine learning techniques, Finpeg Lump sum strategy offers a far better alternative to regular lump sums.

Using various inputs like PE ratio, PB ratio, Interest Rates, we have trained our algorithm to decide the most optimal asset allocation at any given point of time. Applying this intelligence ensures that Finpeg Lump sum strategy delivers a tangible alpha over regular lump sum investments.

Be it a generic NIFTY Index or a portfolio of actively managed funds, our lump sum strategy has consitently generated 3% - 5% alpha over regular lump sum investment. Also, Finpeg lump sum strategy offers phenomenal risk reduction.

Instead of picking funds on an ad-hoc basis, we give you a portfolio of best mutual funds using an extensively researched and time-tested framework.

Best mutual funds today may not be the best 3 years down the line. We make sure that your portfolio is reviewed and optimized so that you are always invested in the best mutual funds.