Best Mutual Funds to Invest in India in 2019

Category-wise ranking of best mutual funds in 2019

Category-wise ranking of best mutual funds in 2019

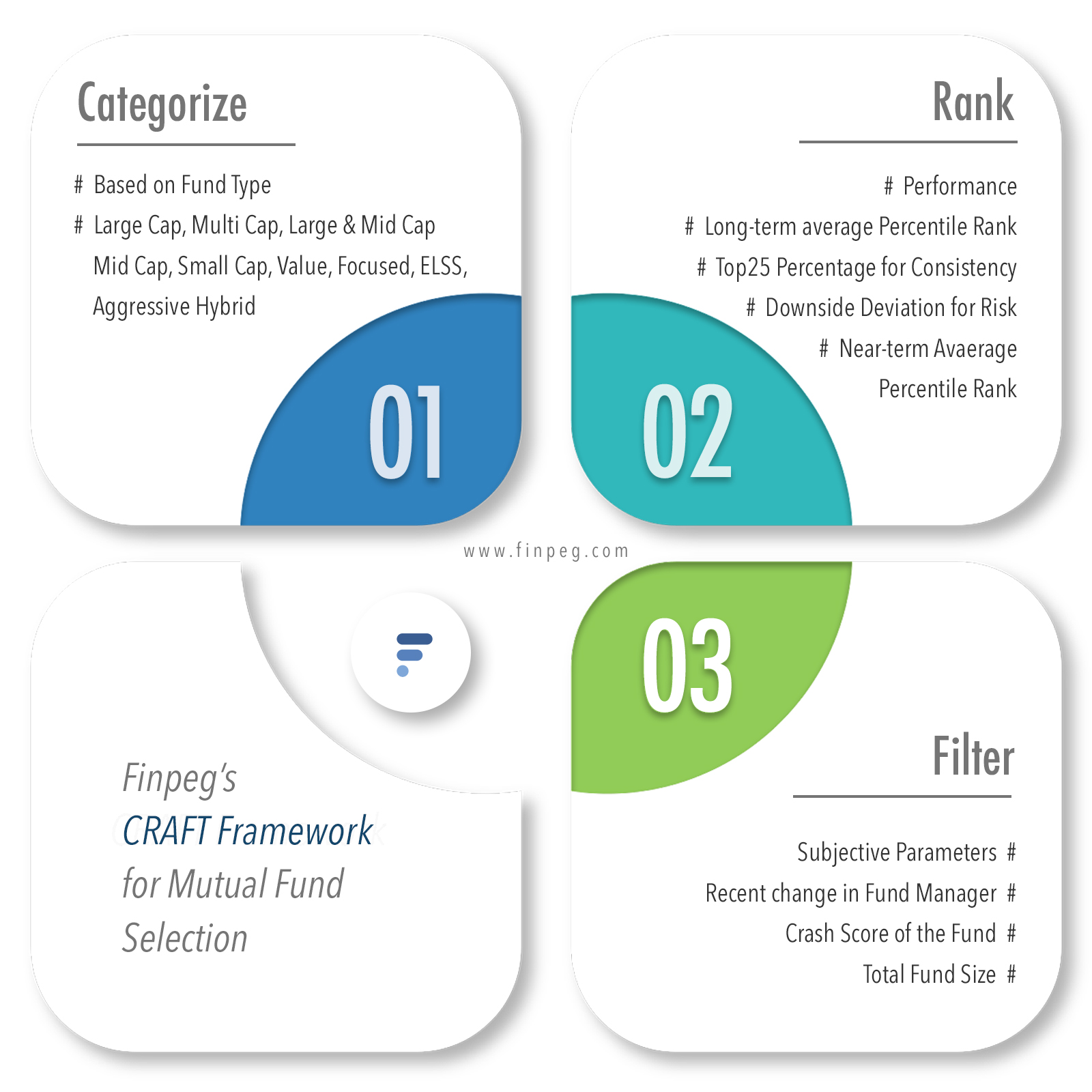

Understanding the CRAFT Framework Categorize, Rank & Filter

Categorize, based on Fund Type

The first step is to categorize the funds into different categories based on their type. For example, large cap is one such category. The main idea here is that you want to compare funds within a category and NOT across categories. Something on the lines of making apple-to-apple comparison.

Rank, based on Fund Performance

Once we have the categories, the next step is to rank the funds within each category. Ranking should be done for funds within a category and NOT across categories. The guiding philosophy that this framework follows can be summed up in a single sentence – “Long-term track record of consistent performance”.

Filter, based on qualitative assessment

And finally, once we have ranked the funds, we should filter funds based on qualitative assessment. Qualitative factors include any recent change in fund manager, total size of the fund and performance of the fund during times of steep market crash.

The entire framework has been explained in detail here - How to pick the best Mutual Funds to invest in? Introducing Finpeg's CRAFT Framework.

Understanding the terminology

Long-term Percentile Rank

This is average percentile rank of the fund since Jan 2004 based on 3-year return. This is a measure of a fund's performance with respect to its peers. Lower the rank, better the performance.

Top25 Percentage

This is the percentage to capture the number of times the fund was in 25% since Jan 2004. This is a measure of consistency of performance of a fund. The higher the percentage, better the consistency.

Downside Deviation

A variant of standard deviation. It only captures deviation below the average return. This captues the risk associated with the fund. Lower the deviation, lower is the risk.

Near-term Percentile Rank

Average percentile rank of the fund in last 1 year based on 1-year return. This is a measure of a fund's recent performance with respect to its peers. Lower the rank, better the performance.

Average Return in 2008-09

Average 1-year return delivered by the fund during the crash of 2008-09. This captues the performance of the fund during times of stress.