Apple and Tesla stock splits came into effect recently.

Before we talk about the absurdity before and after the event, let’s do a stock split 101 for newbies!

Stock Split 101

If a whole cake that costs Rs. 400 is divided into 4 equal pastries, what should be the cost of each pastry?

The cost should be Rs. 100, right? (calculated as 400/4)

This is very similar to what happens in the case of stock splits.

The company announces the date on the day of stock split. And on the day, the stock splits. When the stock split takes places, the stock price is adjusted accordingly.

Let’s take the same cake-pastry example. If the stock price on the day of stock split is Rs. 400 and a 4-for-1 stock split takes effect, we will now have 4 times as many shares each priced at Rs. 100.

Stock split is really that simple!

Why split stocks anyway?

The single biggest reason for a stock split is to make it accessible to more investors.

For example – If a stock is trading at around USD 2000 (like Tesla was just before the split came into effect), there would not be many takers of the stock because of the very high price. If it is split into 5 parts, then each new split stock would trade at around USD 400.

While this is not very important in today’s world where ‘fractional shares’ is a norm, it does have a psychological impact.

Would you like to own one full share at Rs. 100 (after a Rs. 400 share has split into 4) or one full share at Rs. 400?

If you have Rs. 2000 to invest, you can have 20 shares (after the split) instead of just 5 (before the split). And the feeling of owning 20 split but full shares will be better than the feeling of owning 5 full but unsplit shares.

What does a stock split change in a company?

A stock split doesn’t change anything else apart from the number of shares and price of each share which is simply adjusted.

For example – Suppose there are 10,00,000 outstanding shares of the company that trade in the market. If the company does a 2-for-1 stock split, after the stock split takes effect there would be 20,00,000 outstanding share of the company. The price of each share would be halved (1/2) simultaneously.

Does the company’s cash flow change? No.

Does the company’s earning change? No.

Does the company’s opportunity set expand? No.

Does the company’s performance improve? No.

There is absolutely no qualitative change in the company. All that has changed is that the stock has become a bit more accessible to investors due to the split. And the total number of outstanding shares have increased.

Apple and Tesla Stock Splits

The madness began for Tesla stock price the day the stock split was announced.

Tesla announced the stock split on 11th Aug. The stock split was to take effect on 31st Aug. Tesla stock was trading at about USD 1375 on 11th Aug.

The stock split announcement threw the US markets into a frenzy. From 11th Aug to 28th Aug, the stock price went up a staggering 61%! The stock price closed at about USD 2200 on 28th Aug.

It is critical to note that in these 17 days nothing of great significance happened at Tesla. No new invention, patent, contract or a better than expected financial result – absolutely nothing remarkable!

The stock split announcement was the only driver of this unreal 61% increase in stock price in just about a dozen trading sessions.

And if you thought the madness stopped when the stock split took effect, you’re wrong!

In one trading session of 31st Aug, the stock went up a whopping 13%!

While Apple stock split frenzy was relatively subdued, it was crazy nonetheless!

Apple announced the stock split on 30th July. Apple shares were trading for about USD 385 on 30th July. The stock split was to take effect on the same day as the Tesla stock split – 31st Aug.

From 30th July to 28th Aug, the stock price went up a staggering 30%. As of 28th Aug’s close, Apple shares were trading at about USD 500.

For Apple stocks, the madness seems to have stopped after the stock split. But one can’t be sure!

What’s the cause of this madness?

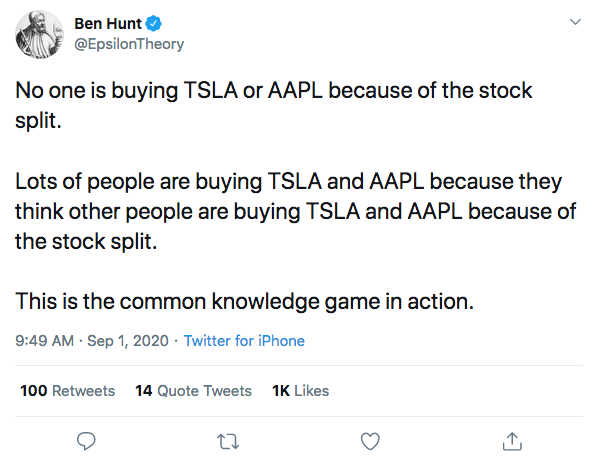

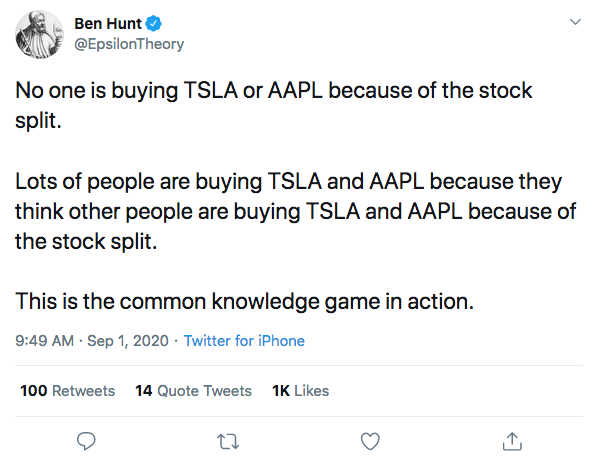

People are buying because they know other people are buying. That’s it, there’s really no other reason.

We’re in a typical bubble!

Now the one only thing we have learnt about bubbles over centuries is that bubbles pop!

It is impossible to predict when a certain bubble will pop.

One of the less rational responses to bubbles is to be a part of it (due to FOMO) and see where it takes you. This is what inflates the bubble further.

But, by far, the most rational response to a bubble is to not participate in it.

Apple and Tesla stock split events will be distinctly recalled by investors once this is over. Just as how pets.com is remembered as the poster child of the 2000 tech bubble.